Financial stress can feel isolating. When you’re buried under mounting bills and persistent calls from creditors, it’s easy to believe you’re facing the challenge alone. The weight of debt can impact every aspect of your life, from your mental well-being to your relationships and future aspirations. But what if there was a clear, structured path back to financial stability?

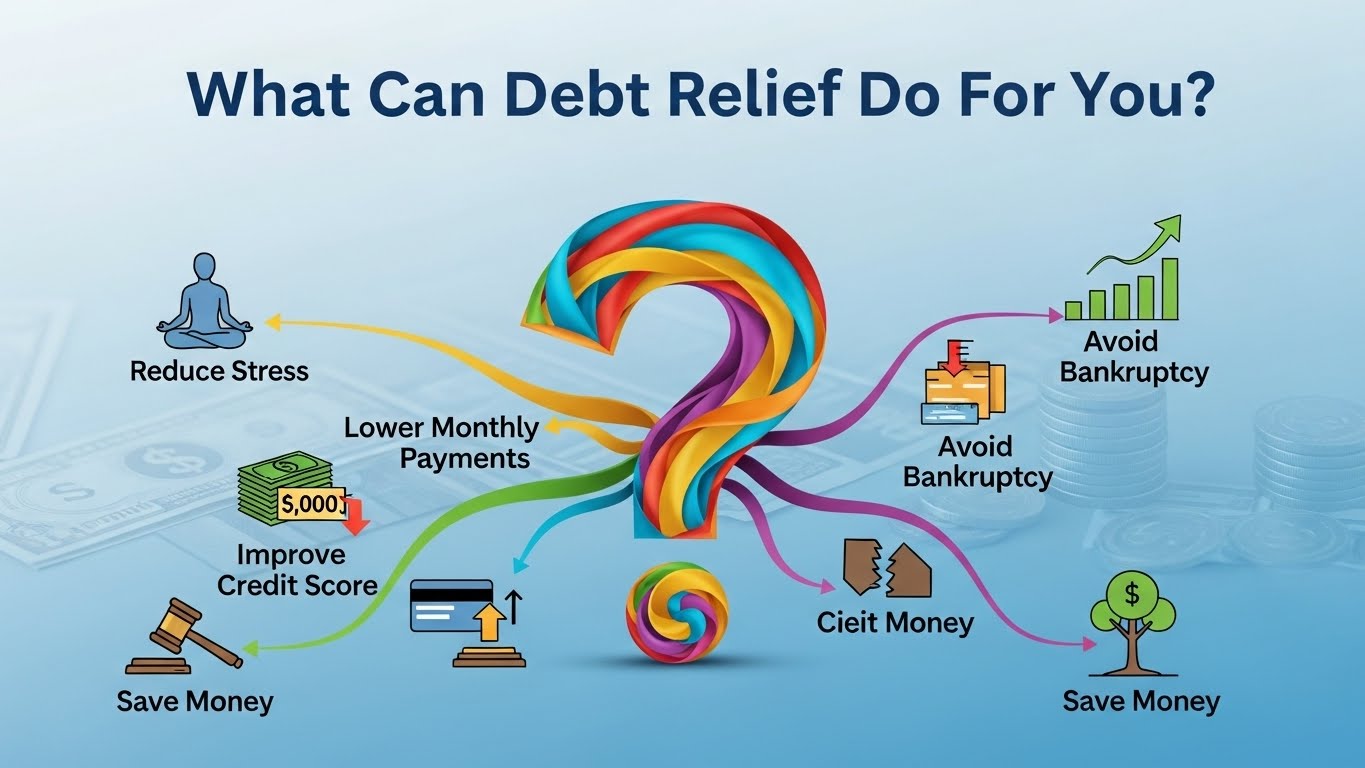

This is where debt relief comes in. It’s a term that encompasses various strategies designed to help individuals manage and reduce their overwhelming debt. It isn’t about finding a magical quick fix; it’s about creating a manageable plan to regain control of your finances. For many, partnering with a professional service is the first step toward lifting that heavy burden and building a brighter financial future.

Understanding how debt relief works can empower you to make an informed decision. This post will explore what professional debt relief services can offer, how they function, and the tangible benefits they can bring to your life. By the end, you’ll have a clearer picture of how you can move from a state of financial distress to one of confidence and control.

How Professional Debt Relief Works

When you partner with a reputable debt relief company like Greenwise Financial Solutions, you’re not just getting a service; you’re gaining an ally. Our primary goal is to advocate on your behalf to reduce the total amount you owe. We handle the complex and often stressful negotiations with your creditors so you don’t have to.

The process typically begins with a thorough, confidential consultation. During this meeting, our experienced specialists will review your financial situation in detail. We’ll look at your total debt, your income, your expenses, and your long-term financial goals. This comprehensive assessment allows us to build a personalized strategy that is tailored specifically to your circumstances.

Once a plan is in place, we get to work. Our team will contact your creditors to negotiate a settlement. Because we have established relationships and a deep understanding of the industry, we can often secure agreements to settle your debts for less than the original amount owed. While we negotiate, you will typically make regular deposits into a dedicated savings account that you control. When enough funds have accumulated, we use that money to pay off the settled debts, one by one, until you are debt-free.

The Key Benefits of a Debt Relief Program

Embarking on a debt relief journey offers more than just financial advantages. It can transform your entire outlook and set you on a path toward lasting stability.

One Manageable Monthly Payment

One of the most immediate benefits of our debt relief program is the simplification of your finances. Instead of juggling multiple payments to different creditors each month—each with its own due date and interest rate—you will make one consolidated monthly deposit into your dedicated account. This simplifies your budget and makes it much easier to stay on track. This single payment is often lower than the combined total of your previous minimum payments, freeing up cash flow for other essential expenses.

Significant Debt Reduction

Our core service is negotiating with your creditors to reduce the principal amount you owe. At Greenwise Financial Solutions, we leverage our expertise and industry relationships to secure the most favorable settlements possible. This means you could pay back a fraction of what you originally owed, helping you become debt-free much faster than you could on your own. Resolving your debt for less than the full balance is a powerful way to accelerate your journey to financial freedom.

An End to Collection Calls

The constant stress of collection calls can be debilitating. Once you enroll in our program, we notify your creditors that you are working with us. This typically directs all future communication to our team, putting an end to the harassing phone calls and letters. This single change can provide immense peace of mind, allowing you to focus on your progress without the constant, stressful reminders of your debt.

A Clear Timeline to Being Debt-Free

Feeling like there’s no end in sight is a common struggle for those with significant debt. A professional debt relief program provides a structured plan with a clear finish line. Based on your personalized strategy, you will know exactly how long it will take to resolve your debts. Having a defined timeline can be incredibly motivating and helps you see the light at the end of the tunnel.

Is Debt Relief the Right Choice for You?

A debt relief program is an effective solution for individuals who are struggling with unsecured debts, such as credit card balances, personal loans, and medical bills. If you find yourself only able to make minimum payments, or if your debt-to-income ratio is becoming unmanageable, this could be the lifeline you need.

It’s important to recognize that this path requires commitment. Completing the program depends on your ability to make consistent monthly deposits. However, for those who are dedicated to resolving their debt and are looking for a lower-cost alternative to bankruptcy, a debt relief program can be a transformative option.

At Greenwise Financial Solutions, we believe that everyone deserves a chance to achieve financial wellness. We provide the tools, the expertise, and the support you need to navigate this process with confidence.

Take the First Step Toward Financial Freedom

Debt Relief provides a structured path to regain control of your finances and reduce financial stress. With Greenwise Financial Solutions by your side, you receive expert guidance, proven strategies, and ongoing support to overcome debt, protect your financial future, and build a more secure and prosperous life.

If you’re ready to stop stressing about debt and start living again, we’re here to help. Contact our team today for a free, no-obligation consultation. Let us show you what debt relief can do for you and how we can help you achieve your financial goals faster than you ever thought possible.